The Reserve Bank of Malawi (RBM) says it has sealed off all the loopholes for siphoning public funds hence cashgate can now be easily detected and dealt with immediately.

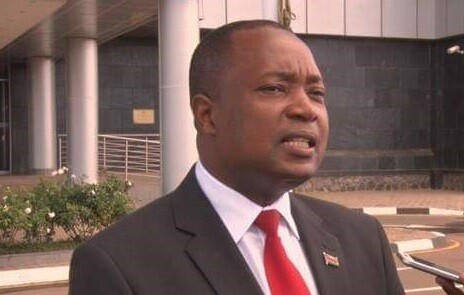

According to the bank’s governor Dalitso Kabambe, RBM has introduced several measures to fight theft of public funds.

In 2013, more than K20 billion was stolen from the government coffers in 2013 in a corruption scandal known as cashgate.

Speaking in an interview, RBM Governor Kabambe said the bank has placed measures to improve the control environment in processing of Government payments to avoid recurrence of cashgate.

He mentioned the high value alert system where any transaction from a certain threshold is reported to relevant authorities connected to Government payment system by SMS and email for easy tracking and vetting.

“Furthermore, within RBM, compliance Officers have been placed in all payment points and have been empowered to review all transactions effected the previous business day so that early detection of any suspicious transaction is done by morning of the following business day,” he said.

He also mentioned the implementation of Positive Pay solution where cheques are automatically validated against a vote account before clearing as well as the introduction of E-statements where RBM prepares and submits electronic account statements to the Accountant General for automated reconciliation in IFMIS.

He said: “This means that Government timely identifies and investigates suspicious transactions. This is a major improvement as previously account statements were prepared and submitted in hard copies to Accountant General for reconciliation and distribution to Ministries, Departments and Agencies.”

Other measures include decentralisation of accounts, cheque signing arrangements and confirmation of cheques valued above K100, 000,000 by senior officers at Accountant General’s Department from the rank of Assistant Accountant General to Accountant General.

According to Kabambe, the Government in conjunction with the Reserve Bank is implementing new integrated Financial Management System (IFMIS) and upgraded core banking system of the Reserve Bank that will facilitate electronic funds transfers.

He said: “The new IFMIS will have enhanced controls that will prevent fraud.”