Authorities say Malawi is poised to boost its revenue collection with the implementation of electronic excise tax stamps.

This innovative measure targets specific goods, including bottled water, alcoholic beverages, cigarettes, and soft drinks, to combat tax evasion and smuggling.

The excise tax stamps, dubbed “Kalondola,” will be rolled out in two phases. The first phase, effective May 1, 2024, covers alcoholic and non-alcoholic beverages, cigarettes, and other products. The second phase, effective July 1, 2024, includes bottled water, carbonated soft drinks, and other excisable products.

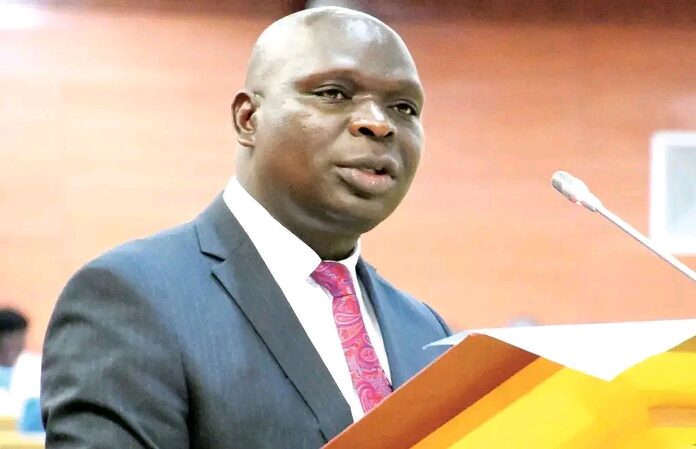

In his 2024-25 Mid-Year Budget Review Statement, Malawi’s Finance Minister Simplex Chithyola, said the electronic tax stamps will verify product authenticity and confirm excise duty payment. It will ensure that products circulating in the market are legal, compliant with tax regulations.

“The measure serves multiple purposes. First, it addresses revenue losses due to tax evasion, which has long been a challenge in the excise goods sector. Second, it discourages the smuggling of taxable goods by making it easier to identify products that have not met legal compliance,” Chithyola states.

He has then urgent stakeholders to work together saying, “The successful implementation of electronic tax stamps will require strong collaboration between the government, businesses, and enforcement agencies to ensure compliance and support economic recovery.”

Meanwhile, Steve Kapoloma, Head of Corporate Affairs at the Malawi Revenue Authority (MRA), emphasizes that the implementation of the initiative in the budget has numerous advantages, including protecting local and legitimate businesses, safeguarding them from unfair competition due to illicit trading.

“The initiative will also enable controlling consumption: reducing the consumption of harmful, unbranded, and counterfeit products whose sources and quality cannot be verified,” said Kapoloma. “The initiative will be optimizing excise tax collection: enhancing tax collection for the improved delivery of social services.”

He further highlighted that the excise tax stamps are not additional taxes but rather a tool to identify products on which excise tax has been paid.

With this initiative, Malawi takes a significant step towards enhanced revenue collection and improved governance.