Some people claim that native doctors help in growth of business but for Stevie Jailosi, using e-payment has been a method to get his business grow.

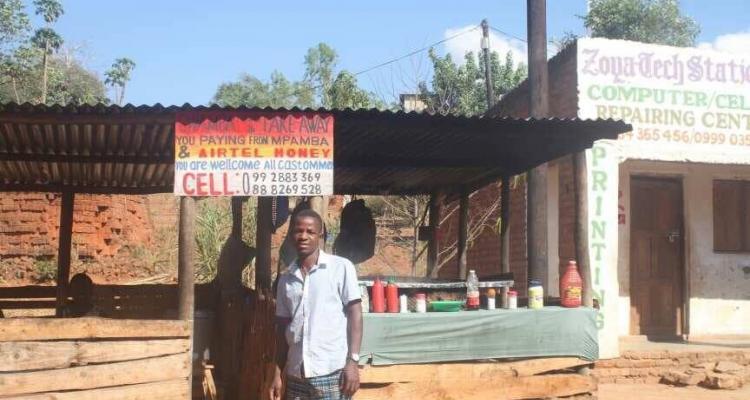

Selling chips popularly known as “Chiwaya”, Jailosi is able to attract more customers with an e-payment that he has adopted.

His customers around Chikanda villages, mostly students from Chancellor College, do not have to carry cash in pockets to buy chips at his takeaway named “Gwamba”.

Jailosi explained that e-payment has been that fertilizer that has helped the “Chiwaya” business grow as the method has attracted more customers.

“I noted that most people these days prefer keeping money in mobile wallets and I decided that my customers can pay me using Mpamba or Airtel Money, now many people do come to buy from me when they are hungry,” said Jailosi.

He added that e-payment has not given him a raw deal as he eyes to have his customers pay e-payment that is connected to the bank.

“Am planning to have bank accounts that support e-payment as well, people are to be paying me through the bank,” he added.

For Jailosi, the K400 that he charges per plate of chips can add up to thousands of kwachas if e-payment continues doing the magic of getting more people to his business.

Reserve Bank of Malawi (RBM) through its spokesperson Mbane Ngwira, while acknowledging the positive development from “Chiwaya” chips seller Jailosi, has urged more people to adopt e-payment in different businesses.

“This is good news, actually it has a lot of benefits, the money is secured from unforeseen circumstances,” said Ngwira in interview with Malawi24.

Ngwira added that RBM is to target rural areas of the country with programs that can help more people to adopt e-payment.

RBM launched a campaign of encouraging citizens in the country to adopt e-payment in buying and selling of goods.

E-payment has been noted to have given financial freedom as people make transactions at anytime, anywhere at the click of a button.