Malawi government has said it wants to reduce domestic debt from current 25 percent of Gross Domestic Product (GDP) to internationally recognised 20 percent of GDP in three years.

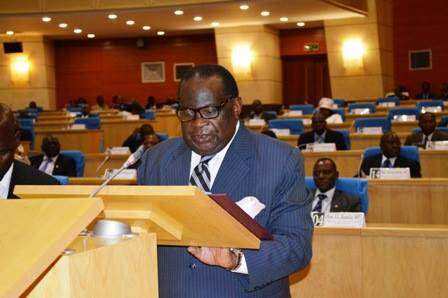

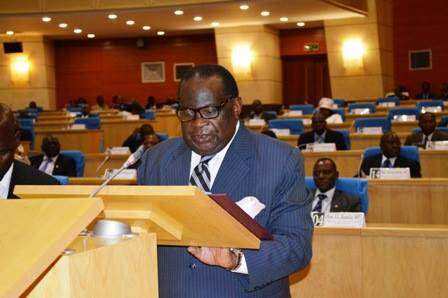

The sentiments were made by Minister of Finance and Economic Planning Goodall Gondwe when he was presenting Mid-Year 2017-2018 Budget Review in the August House on Friday.

Published reports show that Malawi’s domestic debt is at K912.9 billion.

According to Gondwe, government will achieve the debt reduction by repaying some of it and by progressively reducing borrowing.

He then rejected accusations that the President Peter Mutharika administration has an ‘appetite’ for domestic borrowing, saying the indictment does not resonate with the facts.

The minister said government’s annual domestic borrowing has declined from K94 billion in 2015/16 to K37 billion in 2016/17 and to a planned figure of K28 billion in 2017/18.

“Surely, these figures do not reflect a Government that has an appetite for domestic borrowing,” Gondwe said.

He added that the borrowing that occurred since 2014 was necessary because the embezzlement of public funds known as cashgate led to donors withdrawing their budgetary support thus reducing available resources to the budget by 10 percent.

“If the country was to continue with an acceptable level of social welfare, recourse to domestic borrowing was necessary to plug the hole. However, through yearly budgetary adjustments, this is being reduced aggressively as demonstrated by the data,” Gondwe said.

He however stressed that without a revenue substitute, a reduction in either external or domestic borrowing will impact negatively on the development budget.

“Since 2005 apart from the period 2013-2015, more and more of our Development Budget is funded by local resources. This year for example, 38 percent of the development budget is being funded by local revenue and borrowed resources,” Gondwe said.